Investing in Property in Dubai: Expert Tips and Prime Locations

Why Invest in Dubai Real Estate?

Investing in property in Dubai is a hot topic for both local and international investors. Thanks to its tax-free environment, high rental yields, and investor-friendly regulations, Dubai stands out as one of the world’s most attractive real estate markets.

Whether you’re considering buying villa in Dubai, buying apartment in Dubai, or exploring other property types, understanding the process is key to maximizing your returns. This comprehensive guide will walk you through the steps and considerations, from understanding the legal framework to navigating the buying process and managing additional costs.

How to Invest in Dubai Real Estate: Step-by-Step Guide

1. Is it Better to Rent or Buy in Dubai?

Renting may be the way to go if you’re new to Dubai, unsure about how long you’ll stay, or want to test out different neighbourhoods before committing. It offers flexibility and usually requires less upfront investment.

On the flip side, buying villa in Dubai can be a smart move if you plan to settle in Dubai for the long haul, want to build equity, or see property as an investment opportunity.

By evaluating whether renting or buying is the better option, you’re forced to reflect on your long-term plans and your financial situation, which leads us to the next important point.

👉 More on “Is it better to rent or buy in Dubai?“

2. Assess Your Financial Situation

Before investing in property in Dubai, you will need to understand your financial situation and how much you can realistically afford. Dubai has specific mortgage rules and eligibility criteria for both residents and non-residents, so planning ahead saves time and avoids surprises.

If you haven’t already, take the time to create a budget – it’s more engaging than it sounds and can be quite eye-opening. Figure out how much you can realistically save each month for your future home.

Key Considerations:

- Down Payment: Depending on the loan type, down payments can range from 20% to 50% of the home’s purchase price.

- Mortgage Pre-Approval: Getting a mortgage pre-approval from a bank or mortgage broker gives you a clear budget and shows sellers you’re serious.

- Debt-to-Income Ratio: Lenders will check your debt-to-income ratio (DTI) to ensure you can handle mortgage.

- Minimum Monthly Salary: AED 15,000. Self Employed: AED 25,000.

- Employment: Minimum 6 months at current company

- Age Limit: 21 years – 65 years old. 70 if self-employed.

👉 More on Getting a House Loan in Dubai

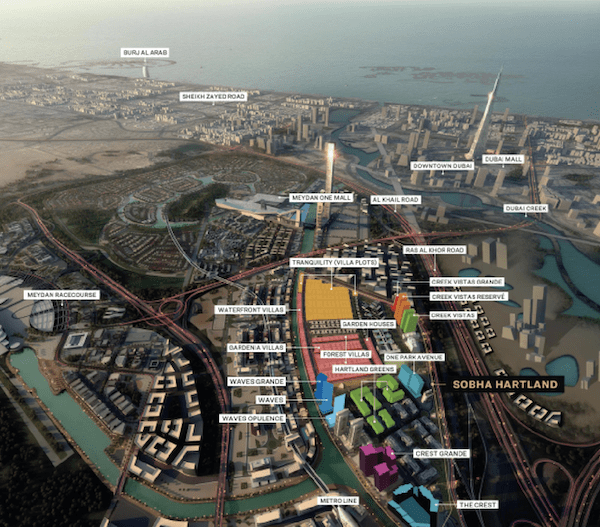

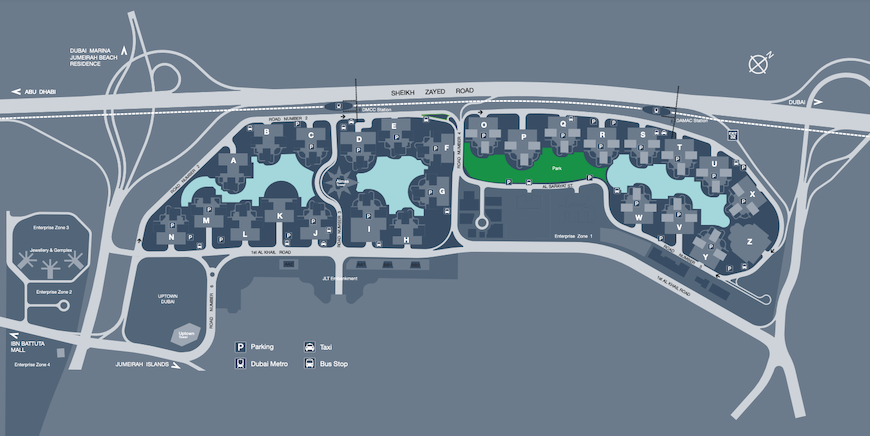

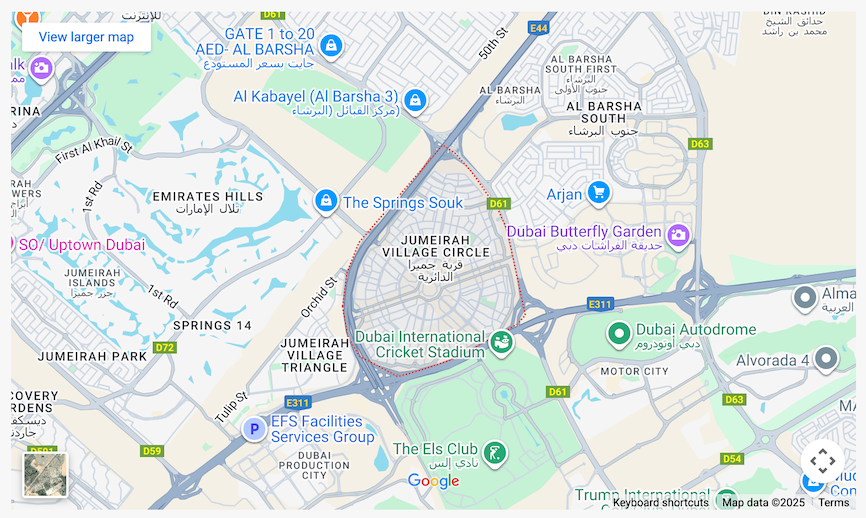

3. Research the Market: Best Area to Invest

As a buyer and a seller, being familiar with where you want to move next will streamline your decision-making process when learning how to invest in Dubai real estate.

Understanding buyer demand in different areas can also help you price your property competitively.

Best Area to Invest in Dubai include:

- Business Bay

- Dubai Hills

- Dubai Marina

- Jumeriah Village Circle

- Dubai South

- Jumeriah Lakes Tower

- Palm Jumeriah

- Arabian Raches

- Jumeriah Beach Residence

👉 If you’re considering selling and buying property as investment properties, focus on “top areas to invest near metro station” as they typically offer higher occupancy and ROI.

👉 If you’re considering selling and buying green-friendly properties for sustainable living, you may want to explore “top 6 eco-friendly communities in Dubai”.

4. Hire a Real Estate Agent

Working with a knowledgeable real estate agent is beneficial whether you’re looking to buy or sell. They have market insights, can negotiate deals, and guide you through the legal aspects of the transaction.

Benefits of Hiring an Agent:

- Pricing Expertise: Agents can help sellers set a realistic price based on current market trends.

- Market Access: They can connect you with listings not always available to the public.

- Negotiation Skills: A strong negotiator can help you get better terms on both your sale and purchase.

5. Understand the Legal Steps

The legal steps for buying property in Dubai include:

Key Steps:

- Agree The Terms Of Sale

- Sign The Memorandum of Understanding (MOU) – Form F

- Applying For NOC From the Developer

- Transferring Ownership At DLD Office

- Pay fees associated with property purchase

6. Get a Property Inspection in Dubai (Snagging)

As a buyer, if the inspection reveals significant issues, you have the opportunity to negotiate repairs or adjust your offer price.

As a seller, getting a property inspection in advance can help avoid surprises that might delay or jeopardize the sale. Fixing any known issues beforehand will enhance your home’s appeal to potential buyers.

What to Expect in a Property Inspection in Dubai:

- Typically, snagging companies in Dubai charge around AED 1 per sq ft of Built Up Area + VAT.

- Inspection usually happens after the buyer makes an offer and there is an agreement between the buyer and seller.

- Snagging in Dubai usually includes MEP (Mechanical, Electric, Plumbing), HVAC (Heating, Ventilation, and Air Conditioning) and pest infestations.

👉 Best Property Inspection Companies 2025

7. Securing a Mortgage

As mentioned earlier, it’s important to get a mortgage pre-approval when investing in property in Dubai. It narrows down properties you qualify for and shows sellers you’re a serious buyer. A pre-approved is valid for 60 days.

Dubai offers two main types:

- Fixed-rate mortgage: Locked in for a set period, usually for 1–5 years.

- Variable-rate mortgage: Fluctuates with EIBOR, rates can change, often monthly or every 6 months

Key Difference:

- Fixed rates offer stability but may be higher

- Variable rates have more uncertainty but potential for lower costs if rates decrease

- Variable rates require more financial flexibility to handle potential payment increases

👉 Best Mortgage Brokerage in Dubai 2025

8. Making an Offer

Once you’ve identified the property you want, the next step is to make an offer. This can be a sensitive process, especially in competitive markets like Dubai.

Tips for success:

- Submit a Clean Offer: with minimal contingencies that might make the seller hesitate.

- Be flexible: with closing dates and other terms to appeal to the seller.

- Have Your Financing Ready: A pre-approval letter to strengthen your credibility.

9. Closing Costs to Expect

Once your offer is accepted, you’ll move into the closing process. During this time, both buyer and seller will sign the necessary documents, and the property will officially change hands. Keep in mind there are always associated costs that come with investing in property in Dubai.

Buyer’s Closing Costs:

- DLD Fees

- Registration Fees

- Agent Fees

- Conveyancing Fees

- NOC Fees

- Mortgage Registration Fees

👉 See the Full Breakdown of Dubai Property Buying Cost

Seller’s Closing Costs:

- DLD Fees

- Registration Fees

- Agent Fees

- Conveyancing Fees

- NOC Fees

- Transfer of Ownership Fees

- Mortgage Fees (Early Settlement Fee, Mortgage Release Fee, Blocking Fee)

👉 See the Full Breakdown of Dubai Property Selling Cost

10. Working with Contractors To Prepare Your New Home

When it comes to getting your new home ready, working with reliable contractors is a key part of the process. Take the time to research how others have approached their renovations, and stagger your payments based on project milestones to keep everything on track.

👉 Best Fit-Out and Renovation Contractors in Dubai 2025

Conclusion

Investing in property in Dubai can be a multifaceted process that requires careful planning and preparation. Whether you’re buying villa in Dubai or an apartment, the city’s real estate market continues to deliver strong returns for smart buyers. By understanding the steps involved, this preparation not only will help mitigate your risks but also enhances your overall buying experience with confidence.