Top 10 Properties to Invest in Downtown Dubai: ROI Analysis

Downtown Dubai remains one of the city’s most dependable investment zones. Even with premium price tags, apartments in Downtown Dubai consistently deliver 5–6% gross ROI, strong rental demand, high liquidity, and long-term value growth – making it a prime choice for investors seeking a mix of stability and prestige.

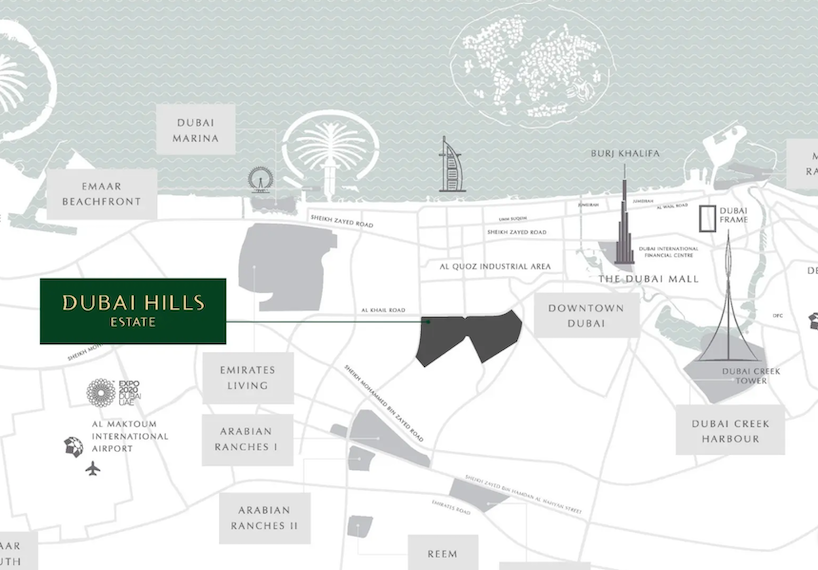

For investors seeking proven performance, limited new supply, and world-class infrastructure anchored by Burj Khalifa and Dubai Mall, these are the top 10 properties in Downtown Dubai worth investing.

Why Invest in Downtown Dubai?

Downtown Dubai remains the city’s most resilient and high-performing real estate district. Key reasons include:

- Global Recognition: Home to Burj Khalifa, Dubai Mall, and Dubai Opera.

- High Rental Demand: Preferred by executives, expats, and tourists.

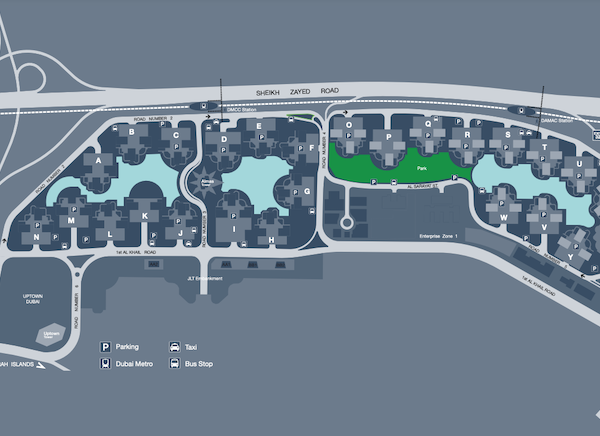

- Strong Infrastructure: Excellent connectivity to Business Bay, DIFC, and Sheikh Zayed Road.

- Consistent ROI: Downtown Dubai apartments typically deliver 5-6% gross rental yields with long-term capital growth.

Quick Insights: If you’re searching for a long-term, resilient investment, Downtown Dubai remains one of the safest luxury bets in the city.

Top 10 Properties in Downtown Dubai

Best 2-Bedroom Apartment Investments

Among all Downtown Dubai apartments, 2-bedroom units offer one of the best entry points. They combine affordability, high occupancy rates, and reliable rental demand from professionals working in Business Bay and DIFC.

| Project | Sale Price* (Last Transaction) | Sq.Ft | Service Charge (AED / Sq.Ft) | Avg. Price Per Sqft* (1 Year Change) | Estimated Gross ROI* | |

|---|---|---|---|---|---|---|

| 1 | Claren Tower Downtown Emaar | 3,430,000 | 1,659 | 22.78 | +3.20% | 6.50% |

| 2 | Burj View Tower | 2,550,000 | 1,487 | 17.00 | +6.93% | 6.20% |

| 3 | The Loft | 2,450,000 | 1,241 | 17.03 | +10.09% | 6.20% |

| 4 | Ellington DT1 | 2,495,040 | 1,716 | 13.72 + 4.18 (AC Charges) | -18.00% | 6.10% |

| 5 | Mada Residences Downtown Dubai | 2,850,000 | 1,619 | 18.96 | +5.83% | 6.10% |

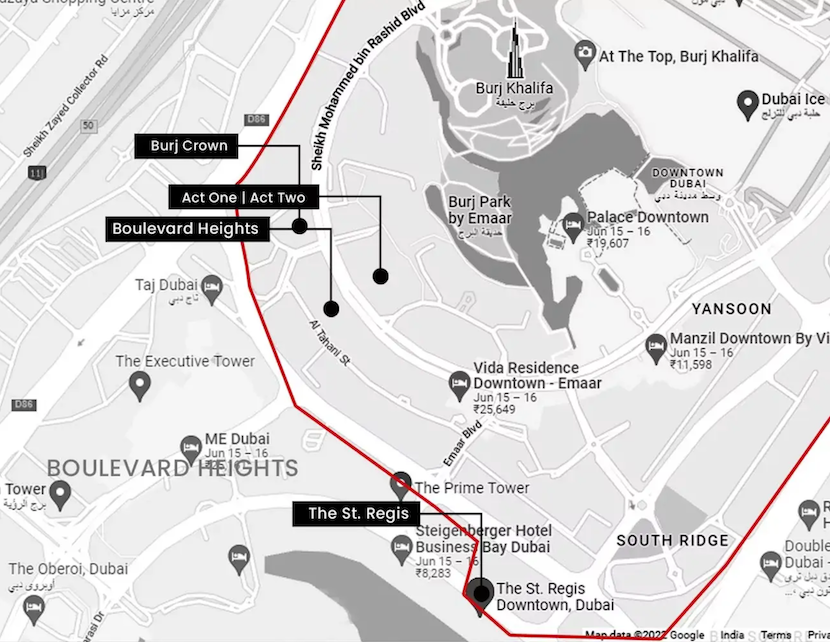

| 6 | BLVD Heights | 3,800,000 | 1,659 | 14.69 + 4.51 (AC Charges) | +6.05% | 5.60% |

| 7 | Boulevard Point | 4,900,000 | 1,915 | 16.53 + 6.08 (AC Charges) | +5.14% | 5.50% |

| 8 | Act One Act Two | 3,320,000 | 1,174 | 17.48 + 5.06 (AC Charges) | -0.34% | 5.40% |

| 9 | Downtown View II | 3,340,000 | 1,313 | 13.47 + 5.59 (AC Charges) | +11.53 | 5.60% |

| 10 | Burj Vista Tower 1 Downtown Dubai | 3,650,000 | 1,416 | 15.72 + 6.16 (AC Charges) | -6.02% | 5.40% |

Investor Insights: What to Weigh Before Buying in Downtown Dubai

Even in a high-demand area like Downtown Dubai, savvy investors look beyond the brochure. Here’s what to evaluate before you commit:

1. Service Charges

Expect service charges between AED 16 – AED 28 per sq. ft. annually, depending on the tower’s facilities and management. Branded residences and high-end towers (like Address and Burj Royal) sit at the upper end of this range.

👉 Tip: Check RERA Service Charge Index on DLD for building service charges.

2. Branded Residences vs. Standard Apartments

Branded properties (like Address Downtown, Vida, or St Regis Residences) typically cost 20–30% higher prices but deliver higher short-term rental demand and occupancy.

💡 Investor Tips:

- Choose branded for passive income and international appeal.

- Choose standard Emaar or private developer units for higher ROI margins.

👉 Explore: Branded Residences Off Plan 2026-2031 Worth Investing

3. Short-Term vs. Long-Term Rental Demand

Before deciding how to rent out your Downtown Dubai property, think about your investment purpose, target tenant, and the amount of work you’re willing to put in.

💡 Investor Tip:

Short-term rentals:

- Higher returns, more hands-on management.

- Appeal to tourists and business travellers looking for high-end stays near Dubai Mall and Burj Khalifa.

Long-term rentals:

- Predictable cash flow and less management effort.

- Appeal to professionals working in DIFC and Business Bay.

👉 Use our FREE Long-Term Rental ROI Calculator or our Airbnb ROI Calculator to project your earnings.

4. Future Supply

While Downtown Dubai is largely built out, a few Emaar off plan projects are still delivering new units.

👉 Explore: Emaar Off Plan 2025-2028 Worth Investing

Final Takeaway

Investing in Downtown Dubai apartments means buying into Dubai’s global lifestyle brand, where luxury, liquidity, and steady ROI converge. Whether you’re starting with an entry-level 2-bedroom apartment or aiming for branded residences, Downtown continues to prove its resilience in every market cycle.

FAQs About Investing in Downtown Dubai

Q: Are Downtown Dubai apartments a good investment in 2025?

Yes. Despite premium prices, the demand for Downtown apartments remains strong, driven by global investors and rental demand from professionals and short-term tenants.

Q: Which area in Downtown Dubai has the best ROI?

Buildings around Dubai Opera and Sheikh Mohammed bin Rashid Boulevard — like Burja Vista Tower, Burj View Tower, and Boulevard Point — currently offer 5–6% Gross ROI.

Q: Is it better to buy an off-plan or ready apartment in Downtown Dubai?

If you want steady rental income now, go for ready units. For potential capital gains, consider off-plan projects nearing handover.