Is Your Dubai Property Value Actually Price Fairly? We Asked the Expert

With Dubai property value fluctuating widely and the market moving at a fast pace, it’s tough to know if you’re getting a fair deal or paying more than you should.

According to Fitch Ratings, a correction is expected soon, with Dubai property prices likely to drop by up to 15 percent. As the market hits peak and prepares for potential adjustments, knowing what properties are really worth is more important than ever for anyone buying properties in Dubai.

We sat down with Dr. Michael Waters, a leading real estate professor to get the inside scoop on how to decode the secrets of fair Dubai property valuation. Dr. Waters has been analyzing UAE real estate for over 20 years, and he’s helped guide hundreds of investment decisions across the emirates.

In our chat, Dr. Waters breaks down simple ways to check if a property’s price makes sense. He also shares a real example from his book to show you exactly how to decide.

How can I Tell if My Dubai Property Value is Priced Fairly?

The most accurate Dubai property valuation comes from analyzing recent comparable sales within the same building or surrounding community.

Property portals, like DXB Interact, Bayut and Property Finder, show the latest Dubai property value when searching for units, and many top real estate brokers have the latest transactions history where you can filter recent sales by specific buildings and units.

Access to this information gives buyers a clear benchmark, removing uncertainty about whether the price they are paying reflects current market conditions.

Keep in mind, properties with premium upgrades or distinctive features, such as waterfront access, renovated kitchens, high-end appliances, or smart home technology, command higher values in the market.

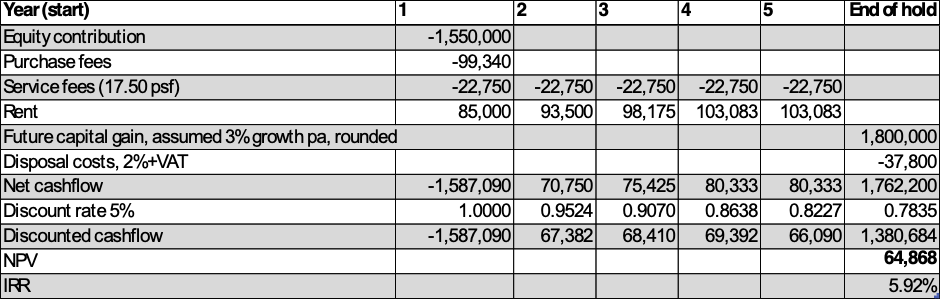

In my book, ‘The Essential Guide to the Dubai Real Estate Market’ (Chapter 2), I show how buyers can accurately price a property using straightforward Excel model that incorporates key market dynamics like current market rent, projected rent growth, service charge payments, and target rates of return based on opportunity cost.

These simple discounted cash flow (DCF) models provide a practical way to validate your investment or purchase decision, helping you decide a fair price for your Dubai property value, independent of any market hype reflected in recent comparable sales.

I think it’s important for buyers to run both a comparable analysis as well as a simple investment appraisal to cross-check your property valuation numbers.

Let me show you a simple example.

Scenario:

Note: This was based off an example I wrote in 2021 so the numbers will have changed since then but the principles stay the same!

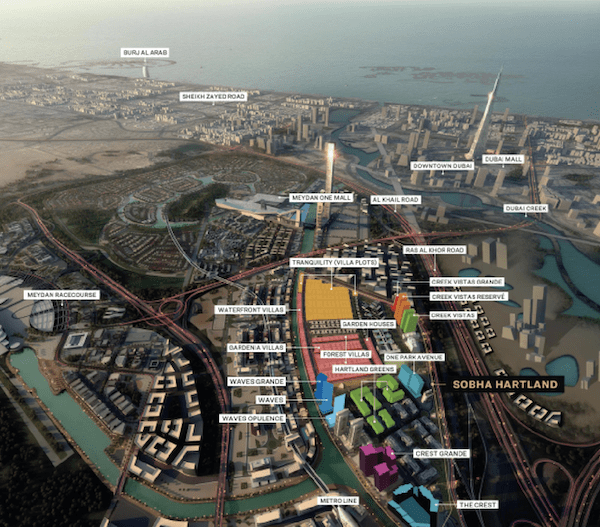

An expat is thinking of buying a 1,300 sq ft investment property value at AED 1,550,000 in a popular freehold master-plan community.

The investor plans to rent the property out for 5 years before selling it. Right now, this property rents out for AED 85,000 per year. Service fees and management fee are AED 17.50 per sq ft.

The RERA rental index indicates that current rents for this type of property range from AED 100,000 to 120,000 per year.

The rent then can be increased by:

- AED 8,500 at Year 2

- AED 4,675 at Year 3

- AED 4,908 at Year 4 (until current market rent stabilization)

The investor is expecting a target return rate on 5%, so, assumes this as an appropriate discount rate.

Key Appraisal Assumptions:

Initial purchase price: AED 1,550,000, cash-purchase

Sale price at end of Year 5: AED 1,800,000, based off long-run average of 3% p.a.

When buying a property in Dubai, there are additional costs to keep in mind.

Here is an overview of these costs, along with a detailed breakdown of how each is calculated:

| Purchase Fees | Amount (AED) |

|---|---|

| Land Department Fee (DLD), 4% + AED 540 | 62,540 |

| Title Registration Fee | 4,250 |

| Agent’s Fee, 2% +VAT | 32,550 |

| Mortgage Loan Registration Fee (0.25% of mortgage loan + AED10) | N/A, cash |

| Bank Arrangment Fee (1% mortgage loan amount + VAT) | N/A, cash |

| Property Valuation Fee | Optional |

| Total | 99,340 |

| Purchase fees as a % of purchase price | 6.4% |

Based on this initial analysis, if the asking price of AED 1.55 million with 5 year holding period (to rent out), he would get an annualized return of 5.92% per year.

This figure would be higher if using a mortgage loan.

Another way to interpret the table above is that, in order to achieve their desired 5% return, the investor should be prepared to offer a maximum price of AED 1.615 million.

If the investor wish to get a 7% target rate of return, the AED 1.55 million asking price would not be reasonable, as it exceeds the maximum price that would meet this return threshold.

If the desired return is 7% instead of 5%, a fair price for your Dubai property value would be AED 1.478 million.