Top 10 Apartment for Sale in JVC: ROI Analysis

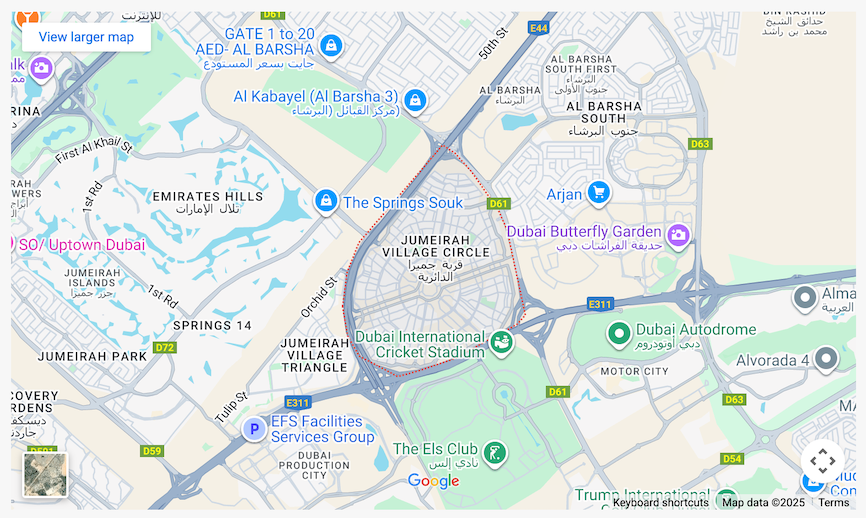

If you’re searching for an affordable apartment for sale in JVC with consistent rental returns, Jumeirah Village Circle (JVC) continues to be one of Dubai’s most promising investment areas. Its central location, steady tenant demand, and reliable ROI make it an accessible choice for both first-time buyers and seasoned investors.

Whether you’re searching for a property for sale in JVC or comparing which buildings offer the strongest ROI, this guide breaks down the Top 10 JVC properties worth investing in for 2025.

Why Invest in JVC?

JVC strikes the perfect balance between affordability, lifestyle, and connectivity.

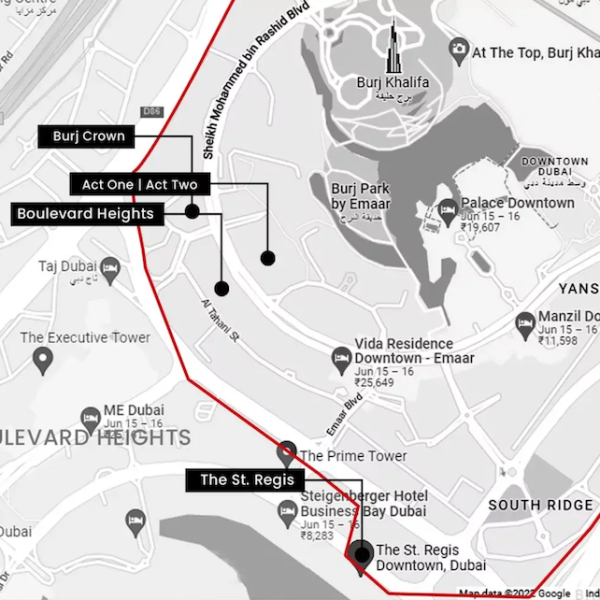

Compared to premium areas like Dubai Marina or Downtown Dubai, prices here are more budge-friendly yet still deliver rental returns — typically between 6% to 9%.

Investors benefit from:

- Lower entry prices compared to Dubai Marina or Downtown.

- Steady rental demand from professionals and small families who prefers lower rent.

- Central location — 15 minutes to Dubai Marina, 10 minutes to Dubai Hills Mall, 20 minutes to Downtown Dubai.

- Community lifestyle with parks, nearby schools, shops, and gyms.

Top 10 Apartment for Sale in JVC – ROI Analysis 2025

When it comes to properties in JVC districts, 1- and 2-bedroom apartments remain investor favorites. They’re affordable, rent quickly and ideal for tenants working in nearby areas like Al Barsha, Dubai Sports City, and Business Bay.

2-Bedroom Apartment

| Project | Sale Price* (Last Transaction) | Sq.Ft | Service Charge (AED / Sq.Ft) | Avg. Price Per Sqft* (1 Year Change) | Estimated Gross ROI* | |

| 1 | Diamond Views 2 | 1,300,000 | 2,060 | 10.99 | +19.25% | 9.1% |

| 2 | Park View Tower | 1,517,739 | 1,354 | 13.57 + 3.11 (AC Charges) | +2.51% | 8.5% |

| 3 | Damac Ghalia JVC | 1,318,944 | 1,054 | 18.43 + 10.47 (AC Charges) | +33.82% | 8.4% |

| 4 | Damac Tower 108 | 1,420,000 | 1,366 | 17.94 + 7.29 (AC Charges) | +4.7% | 7.9% |

| 5 | Bloom Tower A | 1,450,000 | 1,185 | 8.64 | +11.04% | 7.4% |

| 6 | Binghatti Onyx | 1,725,000 | 1,365 | 8.20 | +28.01% | 7.3% |

| 7 | Belgravia Heights 1 JVC | 1,800,000 | 1,125 | 19.89 | +6.68% | 7.3% |

| 8 | Plaza Residences | 1,250,000 | 1,465 | 18.50 | +8.93% | 7.0% |

| 9 | Belgravia 2 | 2,430,000 | 1,866 | 12.35 + 2.18 (AC Charges) | +15.23% | 6.8% |

| 10 | Binghatti Orchid | 2,100,000 | 1,847 | 16.09 | +36.35% | 6.4% |

Quick ROI Tools

👉 Use our FREE Long-Term Rental ROI Calculator or our Airbnb ROI Calculator to project your earnings.

Investor Insights: What to Check Before Buying in JVC

1. Service Charges

Expect service charges between AED 8 – 20 per sq. ft. annually, depending on facilities and management. Premium buildings often have higher service costs which can reduce net yield.

👉 Tip: Check RERA Service Charge Index on DLD for building service charges.

2. Traffic & Commute

JVC’s biggest drawback? Traffic congestion. Without a metro connection yet, residents rely heavily on cars, leading to bottlenecks at Hessa Street during peak hours. Entrances and exits often get congested, making commuting in and out frustrating.

💡 Investor Tip: Choose buildings closer the main exits easier access and shorter drive times. If you don’t commute daily, traffic may be less of a concern.

3. On Going Construction & Noise

New projects are constantly being developed. This means construction noise, dust, roadwork and potholes can affect livability in certain areas.

💡 Investor Tips: Check what’s around your building. An ‘empty plot’ might soon turn into a construction site, bringing noise and dust.

4. Location Within JVC Matters

JVC is divided into districts, and location matters. Prioritize JVC districts near the main exits and in areas that are already fully developed. Also, test the daily routes to key spots like your nearest mall, supermarket, or gym to gauge convenience.

💡 Investor Tips: If the plots around you are already built, you’re in a strong position – these areas typically see higher appreciation and steady rental demand.

Final Takeaway

With its affordability, strategic location, and growing tenant base, JVC remains an accessible choice for investors. However, ongoing construction, noise, and dust, along with traffic congestion, are common resident complaints. With many apartments for sale in JVC and more being built, focus on projects close to the main exits and surrounded by completed developments.

FAQs About Apartment for Sale in JVC

Q: What is the ROI in JVC?

Buildings like Park View Tower, Binghatti Onyx, and Damac Tower 108 – currently deliver 7–9% Gross ROI.

Q: Is JVC suitable for end-users or just investors?

Both. Many residents live here for its affordability, accessibility, and growth potential. However, if you prefer quieter family living and greener setting, consider Dubai Hills Estate as an alternative.

Q: What type of property gives the best ROI in JVC?

Studios and 1-bedroom apartments for sale in JVC often deliver the best rental yields due to steady demand and affordability.

Q: What’s the difference between JVC and Business Bay for investors?

For those comparing real estate in Business Bay vs JVC, the key difference lies in price and entry point, JVC is at a lower cost, making it ideal for mid-budget investors seeking strong rental income.