Top 12 Dubai Creek Harbour Residences | Best ROI 2026 (updated)

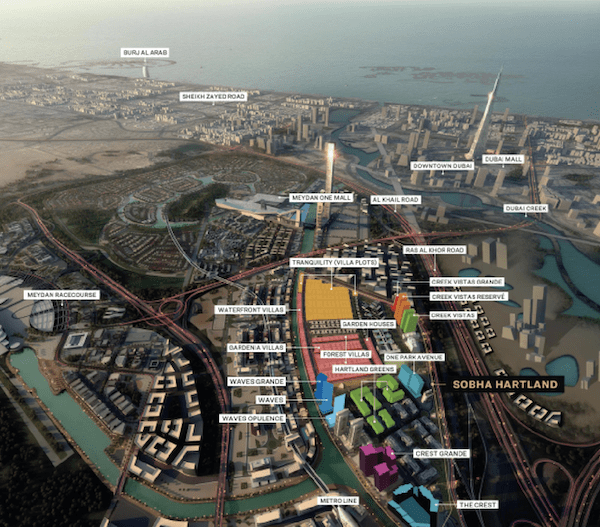

Dubai Creek Harbour is quickly becoming one of Dubai’s strongest investment hubs, driven by major catalysts like the pending Dubai Creek Harbour Tower and the new announcement of the Dubai Square Mall, set to be 3x the size of Dubai Mall. These mega-projects are expected to push long-term capital growth and elevate demand for Dubai Creek Harbour residences.

This guide breaks down the Top 10 Properties to invest in at Dubai Creek Harbour, along with key investor checks, helping you position yourself ahead of the community’s next phase of growth.

Why Invest in Dubai Creek Harbour Residences?

Dubai Creek Harbour is a good choice for investors seeking a combination of rental income, long-term capital growth, and a future-proof master development.

Average Rental Yield: 5.2% – 6.7% Gross ROI

Key Growth Driver:

- Upcoming Dubai Square Mall (Expected 2029): Set to be 3x the size of Dubai Mall – drawing tourism, foot traffic, rentals, and retail demand.

- Future Dubai Creek Harbour Tower: An iconic landmark that will elevate global attention and the value of nearby Dubai Creek Harbour apartments for sale.

- Master Community by Emaar: New parks, beach, retail clusters, waterfront promenades, and walkable neighbourhoods continue to boost long-term value.

- Upcoming Metro Blue Line (Expected 2029) and Water Transport Routes: Connectivity improvements almost always lead to higher rent & capital appreciation.

- Well Connected: Direct access to Ras Al Khor Road. 15 minutes to Downtown Dubai and Dubai Festival City. 15 minutes Dubai International Airport.

👉 See Our Full Guide: Dubai Rental Yield By Community

Compare rental yield % with other top-performing areas like Dubai Marina, Dubai Silicon Oasis, Jumeirah Village Circle, and Business Bay.

Top 12 Dubai Creek Harbour Residences – ROI 2026 (updated)

2-Bedroom Apartment

| Project | Sale Price* (Last Transaction) | Sq.Ft | Service Charge (AED / Sq.Ft) | Avg. Price Per Sqft* (1 Year Change) | Estimated Gross ROI* | |

| 1 | Island Park II | 2,600,000 | 1,237 | NA | +3.09% | 6.7% |

| 2 | Creek Beach | 3,200,000 | 1,209 | 15.75 + 4.92 (AC Charges) | +0.99% | 6.3% |

| 3 | Creekside 18 B | 2,900,000 | 1,143 | 16.58 + 6.17 (AC Charges) | +5.27% | 5.9% |

| 4 | Harbour Views Tower 2 | 2,550,000 | 1179 | 14.23 + 6.17 (AC Charges) | +0.76% | 5.7% |

| 5 | Creek Horizon Tower 1 | 2,570,000 | 1,129 | 16.08 + 6.07 (AC Charges) | +6.71% | 5.6% |

| 6 | Harbour Gate Tower 1 | 3,100,000 | 1,081 | 16.20 + 4.81 (AC Charges) | +3.73% | 5.6% |

| 7 | The Grand | 3,150,000 | 1,293 | 9.52 + 3.29 (AC Charges) | -6.93% | 5.6% |

| 8 | Creek Gate Tower 1 | 2,500,000 | 1,045 | 15.09 + 4.89 (AC Charges) | +4.09% | 5.5% |

| 9 | 17 Icon Bay Dubai Creek Harbour | 2,550,000 | 1,094 | 16.56 + 4.83 (AC Charges) | +8.08% | 5.5% |

| 10 | The Cove Creek Harbour | 3,050,000 | 1286 | 19.23 + 3.16 (AC Charges) | +2-.89% | 5.5% |

| 11 | Creek Crescent | 3,060,000 | 1,053 | NA | +36.43 | 5.4% |

| 12 | Creek Rise Tower 1 | 2,800,000 | 1,256 | 13.15 + 4.32 (AC Charges) | +8.34% | 5.2% |

Quick ROI Tools

👉 Use our FREE Long-Term Rental ROI Calculator or our Airbnb ROI Calculator to project your earnings.

Investor Insights: What to Check Before Buying in Dubai Creek Harbour

1. Service Charges

Expect AED 13–21 per sq. ft. service charges annually, depending on the building’s quality and management. Slightly higher than average due to Creek Harbour’s positioning.

👉 Tip: Check RERA Service Charge Index on DLD for building service charges.

2. Premium Price (But Still Undervalued Long Term)

Entry prices is relatively higher.

AED 1.8M for a 1BR off-plan vs. AED 1.6M for a ready unit of similar size. But, compared to Downtown or Dubai Marina, the community remains undervalued.

Dubai Creek Harbour offers high-end projects, a luxurious waterfront lifestyle, and top-tier amenities. Yet compared to areas like Downtown Dubai or Dubai Marina that offer similar features, the community is still relatively undervalued.

3. Location Within Creek Harbour Matters

Just like in Business Bay, view and positioning can significantly impact your ROI. Waterfront view-facing units or those facing the future Dubai Creek Harbour Tower command higher rents and resale values.

💡 Investor Tips: Prioritize waterfront apartments or Creek Tower view. Always check Google Reviews for each building to gauge management quality, maintenance, and tenant satisfaction.

4. Construction & Traffic Realities

New projects are always popping up in the area, so this means construction noise, dust, and roadworks. Most residents rely on cars or buses, with the nearest metro station being Healthcare City.

Ras Al Khor Road can get quite busy during rush hours, and traffic will naturally increase as more projects and amenities are completed.

Final Takeaway

Dubai Creek Harbour is entering a major growth cycle powered by Dubai Creek Harbour Tower, Dubai Square Mall, and future Metro connectivity. It may take slightly longer to see quick returns compared to more established areas, but if your strategy is long-term hold and capital appreciation, the area offers excellent upside.

For investors looking at Dubai Creek Harbour apartments for sale, it is an ideal time to enter – before the next phase of infrastructure and landmark projects reshapes the entire district.

FAQs About Buying Dubai Creek Harbour Residences

Q: What is the Rental Yield in Dubai Creek Harbour?

Units in The Grand, Creek Beach, and Creek Horizon Tower 1 – currently deliver 5.2–6.7% Gross ROI.

Q: Are Dubai Creek Harbour apartments a good investment in 2026?

Yes. With strong infrastructure plans and Emaar’s track record, the area remains a safe, profitable long-term investment.

Q: What’s the difference between Dubai Creek Harbour and Dubai Marina for investors?

Creek harbour is still developing, offering a quitter, more spacious environment.

Dubai Marina is a fully established community – denser, more lively atmosphere and packed with activities.

Q: What’s the difference between Dubai Creek Harbour and Downtown Dubai for investors?

Downtown Dubai offers the Burj Khalifa, Dubai Mall, and DIFC, but prices and service charges (AED 15–35 per sq ft) are much higher, and traffic is heavy.

Dubai Creek Harbour offers upcoming landmarks like the Dubai Creek Harbour Tower and Dubai Square Mall, lower service charges (AED 12–21 per sq ft), more greenery, and more affordable entry prices.