Top 12 Properties in Dubai International City | ROI 2026 (updated)

Dubai International City has long been one of the go-to spots for investors looking for budget-friendly entry prices and solid rental returns. It’s a fully developed community packed with shops, restaurants, and direct access to Dragon Mart and Sheikh Mohammed Bin Zayed Road (E311) – so area continues to attract both tenants and investors seeking strong cash flow.

Phase 2 International City offers a quieter, more modern vibe with newer buildings, while Warsan Village brings a townhouse living for those eyeing better long-term appreciation. If steady cash flow and low investment risk are what you’re after, International City delivers great value for the price.

Why Invest in Dubai International City?

Average Rental Yield: 7.8% – 9.4% Gross ROI

- Affordable Ownership: One of Dubai’s lowest entry-price communities

- High Tenant Demand: From lower-income professionals and small business owners

- Self-Contained Community: Grocery stores, restaurants, pharmacies, and retail outlets

- Easy Connectivity: Direct access to E311 and Al Manama Street

- Phase 2 International City: Newer, quieter, more modern residential and less congestion

- Warsan Village Townhouses: Secure gated community ideal for families

- Proximity to Key Hubs: Close to Dragon Mart, Academic City and Dubai Silicon Oasis

- Blue Line Metro (Expected by 2029): Will greatly enhance connectivity

👉 See Our Full Guide: Dubai Rental Yield By Community

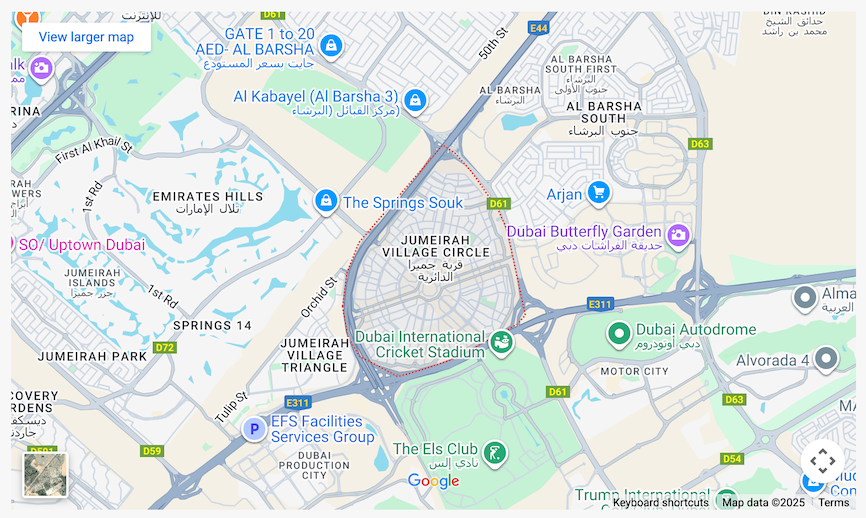

Compare rental yield % with other top-performing areas like Dubai Marina, Dubai Creek Harbour, Jumeirah Village Circle, and Business Bay.

Top 12 Properties in Dubai International City – ROI 2026 (updated)

For investors, studios and 1-bedroom apartments dominate the market. They are affordable, rent fast, and attract consistent tenants working in Dragon Mart, Academic City, or International City itself.

1-Bedroom Apartment Investment

| Project | Sale Price* (Last Transaction) | Sq.Ft | Service Charge (AED / Sq.Ft) | Avg. Price Per Sqft* (1 Year Change) | Estimated Gross ROI* | |

| 1 | Lady Ratan Manor | 420,000 | 617 | 12.06 | +16.60% | 9.4% |

| 2 | Spain Cluster | 430,000 | 742 | 6.08 | +5.70% | 9.3% |

| 3 | Italy Cluster | 460,000 | 936 | 7.37 | +8.22% | 9.2% |

| 4 | England Cluster | 341,320 | 742 | 5.91 | +7.30% | 9.2% |

| 5 | Trafalgar Central | 545,000 | 645 | 8.00 | +10.46% | 8.8% |

| 6 | Universal Apartments | 400,000 | 657 | 8.86 | +25.58% | 8.8% |

| 7 | CBD 32 Classic Apartments | 433,000 | 929 | 8.87 | +9.72% | 8.6% |

| 8 | Al Dana Tower | 510,000 | 678 | 7.68 | +15.98% | 8.5% |

| 9 | Indigo Spectrum 1 | 700,000 | 789 | 12.19 | +11.00% | 8.5% |

| 10 | Green View 1 | 645,000 | 748 | 12.06 + 3.35 (Add. Charges) | +12.44% | 8.0% |

| 11 | Olivz Residence by Danube Properties | 805,000 | 629 | 16.61 | +8.52% | 7.8% |

| 12 | Lawnz by Danube | 695,000 | 647 | 12.30 | +8.13% | 7.8% |

Quick ROI Tools

👉 Use our FREE Long-Term Rental ROI Calculator or our Airbnb ROI Calculator to project your earnings.

Investor Insights: What to Check Before Buying in Dubai International City

Before investing, consider your budget, tenant profile, commute distance, and building upkeep. Here are key factors to evaluate:

1. Service Charges

Expect AED 7–16 per sq. ft. service charges annually, depending on the building’s quality and management. Generally, older or poorly maintained buildings may have lower service charges, but they also tend to attract weaker rental demand and require more upkeep over time.

👉 Tip: Check RERA Service Charge Index on DLD for building service charges.

2. Sewage Smell

Some clusters (like Emirates and Morocco Cluster), are positioned closer to the Aweer sewage treatment plant, so sewage smell can be noticeable. Odour varies by cluster – especially in certain wind directions or unit orientations.

3. Location Matters

Phase 1: Older, more established, full of small shops and restaurants. Expect traffic bottlenecks at Al Manama Road and limited on-street free parking.

Phase 2 (Warsan 4): Newer, quieter, and more family-oriented. Less congestion, better building quality.

👉 Tip: Focus on Phase 2 and CBD clusters if you want stronger tenant profiles and newer developments.

4. Tenant Profile & Maintenance Cost

In some clusters, tenants are often single working men employed in construction or labor jobs, and this group may not always maintain the property well. Landlords may need to refurbish or repair damages between tenancies, which can reduce overall net ROI.

Final Takeaway

Dubai International City remains a top choice for investors seeking good cash flow and high rental yields with very low entry costs. While capital appreciation may be limited compared to prime areas like Downtown or Dubai Marina, rental demand stays resilient, making it ideal for investors focused on steady income and lower-risk returns.

If you want newer builds and a quieter lifestyle, explore Phase 2 International City or Warsan Village townhouses for long-term stability.

FAQs About Real Estate in Dubai International City

Q: What is the ROI in Dubai International City?

Units in England Cluster, Al Dana Tower, and Olivz Residence by Danube Properties – currently deliver 7.8–9.2% Gross ROI.

Q: What type of property gives the best ROI in International City?

Studio and 1-bedroom often deliver the best rental yields due to steady demand and affordable rents.

Q: Are Dubai International City apartments still good investments in 2026?

Yes. International City is a built-out community with Phase 2 International City offering more modern, quieter, and family-friendly developments compared to the older clusters in Phase 1. Rental demand is consistent and not driven by “future promises.”

Q: What’s the difference between International City and Warsan Village for investors?

Warsan Village features townhouses in a gated setup, appealing to families who prefer more space and privacy, while International City caters mostly to singles in apartments.