House Flipping in Dubai – Best Flipping Strategies for ROI

What Are Popular House Flipping Strategies in Dubai?

House flipping in Dubai is delivering exceptional ROI for savvy investors, with returns of 30-50% in prime locations becoming the new normal. Thanks to zero capital gains tax, booming demand, and strong rental yields, Dubai’s house flipping market outperforms most global alternatives.

But what are the most popular flipping strategies in Dubai today? Let’s break down the six approaches investors use to maximize profits.

1. Off-Plan / Handover Flips

How It Works: Buy a property off-plan (before it’s completed) from a developer, then resell the contract before handover.

Why It’s Popular:

- Developers often offer 5–10% down payment entry points.

- Many end-users and investors prefer ready units, pushing up prices at delivery.

- Buyers lock in today’s price but resell at 10–25% higher when handover arrives.

ROI Potential

- Developers offer flexible payment plans

- Early investors can sell before completion in 1-3 years without holding the property.

- High demand for ready-to-move properties allows quick 10–25% profit on resale.

Risks: Tied to market conditions and developer timelines; not every project appreciates.

Best Areas:

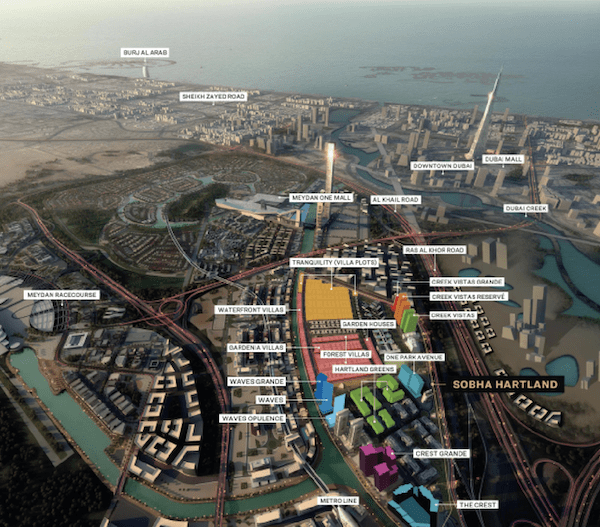

- Dubai Creek Harbour – resale premiums rise at handover due to strong end-user interest.

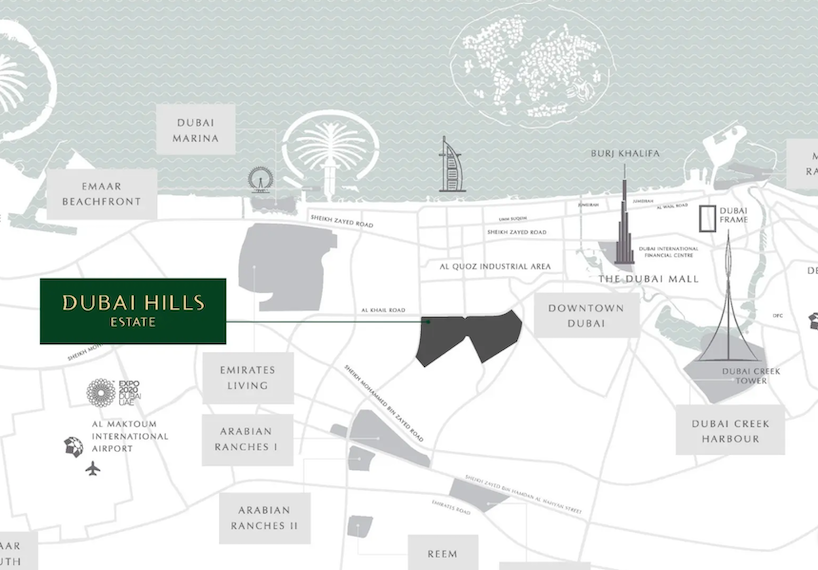

- Dubai Hills Estate – family-focused, consistent demand for villas and townhouses.

- Arjan & Dubai South – affordable entry points, fast growth.

- Business Bay – high rental demand near Downtown.

- Jumeirah Village Circle (JVC) – investor-friendly community with consistent absorption.

👉 Emaar Off Plan Projects Worth Investing 2025 – 2026

2. Value-Add House Flipping (Renovation + Resale)

How It Works: Buy a ready property (often older or dated), renovate or modernize it, then resell at a premium.

Why It’s Popular:

- Dubai has many apartments and villas built 10–20 years ago, especially in communities like Jumeirah, Emirates Hills, and the Marina.

- Smart upgrades (kitchens, flooring, smart home systems, landscaping) boost resale value significantly.

ROI Potential:

- Many properties built in the 2000s are prime for upgrades (kitchens, flooring, landscaping) that boost resale value.

Risks: Renovation costs, permits, and project delays can eat into profits.

Best Areas:

- Jumeirah Islands – villas with renovation upside.

- The Springs & The Meadows – dated Emaar communities, high family demand.

- Dubai Marina – older apartments that benefit from modern interiors.

👉 14 Smart Renovations That Boost Home Value & ROI in Dubai

3. Luxury Property Flipping

How It Works: Focus on high-end villas or penthouses in prime areas like Palm Jumeirah, Emirates Hills, Downtown Dubai.

Why It’s Popular:

- Demand from ultra-high-net-worth buyers (especially from Europe, Russia, India, China, Saudi).

- Luxury homes in Dubai can double in value with well-done renovations.

ROI potential: Global demand from UHNWIs, buyers willing to pay premiums for turnkey luxury homes.

Risks: High capital requirement; luxury markets can cool faster than mid-tier segments.

Best Areas:

- Palm Jumeirah – beachfront villas and penthouses.

- Emirates Hills – “Beverly Hills of Dubai,” mega-mansions often rebuilt or heavily renovated.

- Downtown Dubai – Burj Khalifa views, luxury apartments.

👉 Top Branded Residences Off Plan Handover in 2026 – 2031

4. Quick Studio & Apartment Flips

How It Works: Buy small, affordable studios or 1-bed apartments in emerging communities (JVC, Arjan, Dubai South), then resell quickly.

Why It’s Popular:

- Lower entry price point = wider buyer pool.

- These areas are growing fast, with steady tenant demand.

ROI Potential: Attracts first-time buyers and renters, easier resale due to affordability, smaller margins, faster exit.

Risks: Oversupply in mid-market apartments can limit gains.

Best Areas:

- JVC (Jumeirah Village Circle) – affordable entry, steady demand.

- Arjan – growing mid-market area with new amenities.

- Dubai South – future growth from Expo City and airport expansion.

5. Fractional & Crowdfunded House Flipping

How It Works: Crowdfunding platforms (e.g. SmartCrowd & Getstake) that pool investor money to buy, renovate, and resell.

Why It’s Popular:

- Low entry barrier compared to buying entire properties.

- Professional teams handle renovations, marketing, and resale.

ROI Potential: Platforms focus on high-value properties where fractional pooling makes sense.

Risks: Shared decision-making, less control over exit timing.

Best Areas:

- Downtown Dubai – trophy apartments with strong liquidity.

- Palm Jumeirah – high-ticket villas, often renovated for resale.

- Dubai Hills Estate – premium villas with quick resale appeal.

6. Long-Term Buy-to-Flip

How it works: Buy a property, renovate, rent it out for short-term or long-term yield, then sell after capital appreciation.

Why It’s Popular:

- Rental income + resale profit.Particularly useful in uncertain market cycles.

ROI potential: Cash Flow + Property Appreciation

Risks: Holding costs (Service charges, maintenance, financing costs add up.) Requires active management (especially short-term rentals).

Best Areas:

- Dubai Marina – short-term rental hotspot, then resale.

- Downtown Dubai – high Airbnb demand, luxury resale later.

- Palm Jumeirah – holiday rental income plus strong appreciation.

👉 Try our FREE Long-Term Rental ROI Calculator or our Airbnb ROI Calculator to project your earnings.

Summary: Where to Flip What

| Strategy | Timeline | Best For | Best Areas |

| Off-Plan / Handover Flipping | 1 – 3 Years | Low-capital, high-leverage investors | Dubai Hills, Creek Harbour, Arjan, Dubai South, Business Bay, JVC |

| Value-Add Renovation | 6 – 18 Months | Hands-on, design-savvy flippers | Jumeirah Islands, The Springs, Meadows, Marina |

| Luxury Flips | 2 – 4 Years | HNW investors with deep pockets | Palm Jumeirah, Emirates Hills, Downtown |

| Crowdfunding Flipping | 12 – 18 Months | Passive investors, smaller budgets | Downtown, Palm Jumeirah, Dubai Hills |

| Studio/Apartment Quick Flip | 6 – 12 Months | Entry-level, smaller budgets | JVC, Arjan, Dubai South |

| Long-Term Buy-to-Flip | 2 – 5 Years | Cash Flow + Resale | Marina, Downtown, Palm Jumeirah |

Final Word: Which Strategy Is Best?

The best flipping strategy depends on your budget, risk appetite, and timeline:

- Off-plan flips suit investors seeking quick appreciation with lower upfront costs.

- Renovation flips offer higher ROI but require more active involvement.

- Luxury flips deliver the biggest profits, but also carry higher risks.

- Fractional flips democratize house flipping for small investors.

House flipping in Dubai isn’t a get-rich-quick scheme, but if you’re smart about location, stick to your budget, get the timing and renovation right, it could be a lucrative investment strategy for Dubai real estate.