Dubai Rental Property: Rental Yield Comparison By Community (Updated 2026)

Searching for the highest rental yield in Dubai and wondering which areas actually deliver strong returns from a Dubai rental property?

Whether you’re buying your first Dubai rental property, building passive income, or expanding an existing portfolio, this guide explains how rental yield works in Dubai, compares top communities by ROI, and shows you how to choose the right Dubai rental property with confidence.

What Is Rental Yield in Dubai?

Rental yield is the simplest way to measure how much income your investment generates.

Gross Rental Yield = (Annual Rent ÷ Property Price) x 100

This metric helps investors quickly compare properties and communities.

In Dubai, rental yields vary widely by community, property type, tenant demand, and service charges – which is why understanding the numbers is key before buying.

Dubai Rental Yield by Community (ROI Comparison 2026)

Below is a comparison of Dubai communities with their current gross ROI, based on market data and investor performance trends.

| Area | Average Gross ROI* | Key Highlights | Investor Appeal | ROI Analysis | |

| 1 | Dubai Marina | 5.2 – 6.8% | Waterfront appeal, tourist appeal | Short-term rental / Mixed-use investors / Liquidity | Dubai Marina ROI |

| 2 | Dubai Hills | 5.5 – 6.6% | Emaar community, Long-term growth, Dubai Hills Mall | Family investors / End-users | Dubai Hills ROI |

| 3 | Downtown Dubai | 5.3 – 6.4% | Global prestige, Burj Khalifa views, Dubai Mall | Luxury buyers & Corporate tenants / Professionals | Downtown Dubai ROI |

| 4 | Palm Jumeirah | 4.6 – 6% | Beachfront living, tourist appeal, luxury resort lifestyle | Luxury buyers / Short-term rental / Mixed-use investors | Palm Jumeriah ROI |

| 5 | Jumeirah Beach Residences (JBR) | 4.5 – 6.8% | Direct beach access, tourist appeal, The Walk | Short-term rental investors / Beachfront buyers | JBR ROI |

| 6 | Business Bay | 6.5 – 8.6% | Central location, close to DIFC & Downtown | Mid-market Investors / Professionals / Yield-Focused | Business Bay ROI |

| 7 | Dubai South | 4 – 9% | Airport expansion, Long-term growth | Budget investors / Yield-Focused | Dubai South ROI |

| 8 | Jebel Ali / Discovery Gardens / Al Furjan | 6.8 – 9.2% | Affordable, near metro, strong logistic demand, low service charges | Budget investors / Yield-Focused / Consistent Renters | Jebel Ali / Discovery Gardens / Al Furjan ROI |

| 9 | Jumeirah Village Circle (JVC) | 7.1 – 8.5% | Affordable, strategic location, growing tenant base | Budget investors / Yield-Focused / Consistent Renters | JVC ROI |

| 10 | Jumeirah Lake Towers (JLT) | 6.7 – 8.5% | 2 Metro Access, opposite Marina, walkable community | Professionals / Long-Term Renters / Mixed-use | JLT ROI |

| 11 | International City | 7.8 – 9.4% | One of Dubai’s lowest entry-price communities with high rental yields | Budget investors / Yield-Focused / Consistent Renters | International City ROI |

| 12 | Dubai Silicon Oasis (DSO) | 7.5 – 9.4% | Tech-hub, university students, affordable, self-contained community | Mid-market investors / Yield-Focused / Consistent Renters | DSO ROI |

| 13 | Dubai Creek Harbour | 5.2 – 6.7% | Upcoming Dubai Creek Tower, Dubai Square Mall, Future Metro, Walkable community | Long-term investors & Waterfront buyers / Strong capital appreciation potential | Dubai Creek Harbour ROI |

| 14 | Tilal Al Graf | 5.1 – 5.9% | Lagoon living, Strong family end-user demand, Premium villas and townhouse | Lifestyle Buyers & Long-term investors | Tilal Al Ghaf ROI |

| 15 | Meydan | 5.5 – 7.9% | Mid-Rise residentials ideal for professionals and families seeking quick access to Downtown & Business Bay | Long Term Investors/ Yield-Focused / Lifestyle Buyers | Meydan ROI |

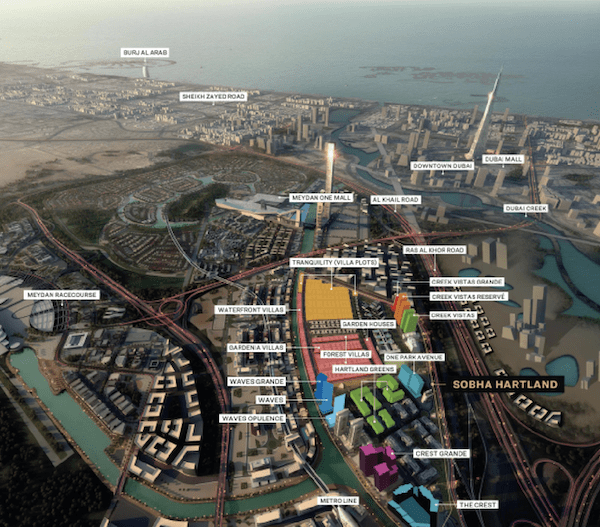

| 16 | Sobha Hartland 1 | 6.1% – 7.0% | Central location near Downtown Dubai with low-rise density, green spaces | Young Professionals & small families / strong end-user appeal | Sobha Hartland ROI |

6 Key Factors That Affect Your Dubai Rental Yield

1. Location

Location is the biggest driver of rental demand. Communities with strong infrastructure, transport links, and lifestyle amenities tend to generate higher rental yield because they attract tenants and stable occupancy.

👉 Tip: Understand your location! Before buying a rental property in Dubai, visit the community at different times of day. Notice foot traffic, construction noise, accessibility, retail convenience, and tenant demographics.

2. Local Businesses & Amenities

Tenants – whether long-term or short-term – want convenience.

Long-term tenants focus on nearby groceries, schools, and work hubs, while short-term visitors care most about quick access to the beach and popular attractions.

Look for areas close to:

- Supermarkets

- Coffee shops

- Schools

- Metro stations

- Beaches / tourist attractions (for holiday homes)

👉 Tip: If big brands like Starbucks, Carrefour, Waitrose or Spinneys are present, it’s usually a sign the area has strong growth and rental demand. Invest in communities where you think tenants want to live.

3. Property Type

Dubai’s rental market is dominated by young professionals and expats – meaning apartments usually outperform villas for rental income.

Studios and 1-bedroom apartments in mid-market communities often deliver the higher rental yield, especially for investors targeting cash flow.

Why they perform well:

- Lower purchase price

- High tenant demand

- Cheaper furnishing costs

- Faster resale liquidity

👉 Note: Facilities and amenities, proximity to Metro, also affect rental property demand.

4. Property Condition

New or old? Off plan property or resale?

Newer buildings usually come with:

- Fewer maintenance issues

- Modern layouts

- Updated facilities

- Higher rental appeal

Older properties can still deliver high ROI – but you will need to be prepared for more repairs and upgrades.

5. Occupancy Rate

A high occupancy rate protects your Dubai rental property from long vacancy periods, which is one of the biggest risks to your ROI.

Ideally, you want the occupancy rate to be 100%!

If you prefer guaranteed income, target:

- Areas with strong long-term tenants

- Properties with existing leases

- Established communities with stable demand

Short-term rentals can achieve higher revenue, but require more active management and carry higher vacancy risks.

👉 More on Long-Term Rental vs Short-Term Rental

6. Service Charge & Hidden Fees

Service charges in Dubai range widely – from AED 8 to AED 30 per sq.ft depending on property type, size, and location.

High service charges – especially in luxury areas like Palm Jumeirah – can significantly reduce net ROI.

👉 Tip: Check RERA Service Charge Index on DLD for building service charges.

For short term rentals, factor in these additional fees:

- DTCM holiday home permit

- Furnishing cost

- Property management

- Tourism dirham fees

👉 Details on Cost of Buying a Property in Dubai

Use ROI Calculator Before You Buy

Gross rental yield is a good starting point, but it leaves out all the addition costs that affect your profit.

Our Dubai ROI calculator includes all upfront fees, service charges, and ongoing costs so you can accurately measure the true ROI of any rental property.

Dubai Rental Yields Calculator

✔ In short, assuming all other factors are equal, a property with a greater cash flow is the better investment.

Conclusion: How to Maximize Rental Yield from a Dubai Rental Property

Dubai rental properties can deliver strong and consistent returns – but only with proper analysis.

The strongest investments come from:

- Understanding community dynamics

- Factoring in all costs

- Maximizing occupancy

- Comparing net (not gross) ROI

With the right due diligence, you will find one that meets your financial goals and delivers dependable rental income.

FAQs About Dubai Rental Property

1. What is a good rental yield for a Dubai rental property?

A good rental yield for a Dubai rental property typically ranges between 6% and 8% gross. Prime areas may offer lower yields with stronger capital appreciation, while mid-market and emerging communities often deliver higher yields due to lower entry prices and strong tenant demand.

2. Which area has the highest rental yield in Dubai?

Communities such as Dubai Silicon Oasis, International City, JVC, JLT, and parts of Jebel Ali consistently rank among areas with the highest rental yields in Dubai, often achieving 7% to 9% gross ROI, driven by affordability, metro access, and steady long-term tenant demand.

3. Are apartments or villas better for rental yield in Dubai?

Apartments generally outperform villas for rental yield in Dubai. Studios and one-bedroom apartments attract the largest tenant pool, require lower upfront investment, and offer higher occupancy rates, making them more suitable for investors focused on consistent rental income and cash flow.

4. What should investors check before buying a Dubai rental property?

Investors should evaluate location demand, service charges, occupancy rates, property condition, and net ROI, not just headline yields. Reviewing comparable rents, visiting the community, and using a detailed ROI calculator helps ensure the Dubai rental property aligns with income and risk goals.