Top Tilal Al Ghaf Villas: Their ROI & Rental Yield in 2026

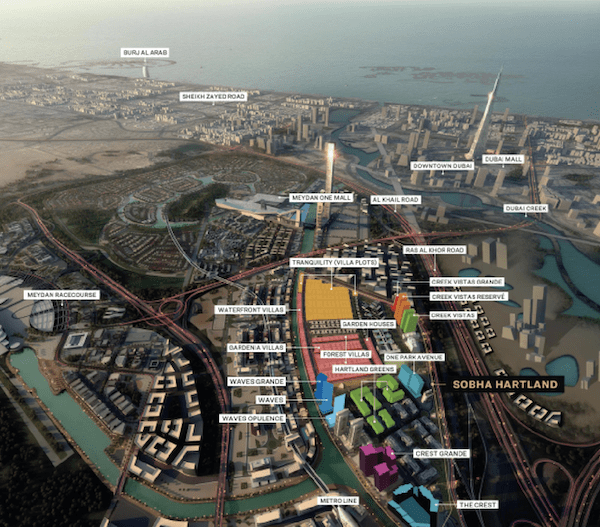

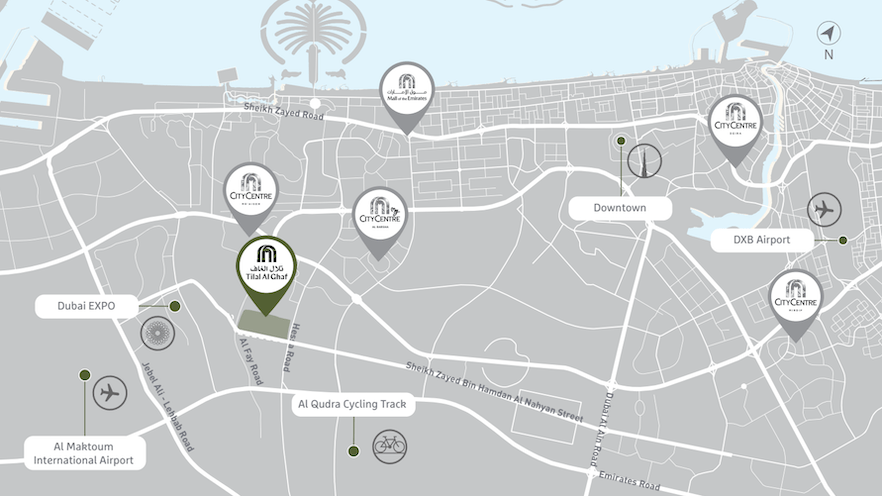

Located behind JVC and Dubai Sports City, Tilal Al Ghaf is a master-planned community centred around a lagoon, with its first homes handed over in 2023. Since then, Demand has been steady, driven by owner-occupiers and long-term investors

Developed by Majid Al Futtaim, Tilal Al Ghaf stands out for its lifestyle-focused planning and relatively limited supply compared to many newer villa and townhouse communities.

This guide outlines Tilal Al Ghaf top properties to consider for 2026 investment, alongside key investor checks to assess before buying, so you can evaluate where the community fits within a broader Dubai property strategy.

Why Invest in Tilal Al Ghaf?

Tilal Al Ghaf location stands out due to its integrated lagoon lifestyle, family-centric planning, and strategic connectivity.

Average Rental Yield: 5.1-5.9% Gross

- Well Connected: Direct access to Hessa Street, quick links to Sheikh Zayed Road and Sheikh Mohammed Bin Zayed Road

- Neighbouring hubs: Dubai Sports City, Motor City, and Dubai Hills

- Schools: Near school clusters in Al Barsha and Dubai Hills, with Royal Grammar School (RGS) within Tilal Al Ghaf

- Standout feature: Al Ghaf lagoon (70,000 square metre lagoon) offering a range of water-based activities

- Master Developer: by Majid Al Futtaim with eco-friendly designs and community planning

- Sub-communities: a mix of affordable townhouses and family-friendly villa, and luxurious lagoon-facing homes.

- Lifestyle amenities: Private beaches, Distrikt Tilal Al Ghaf, cluster retail zones

👉 See Our Full Guide: Dubai Rental Yield By Community

Compare rental yield % with other top-performing areas like Dubai Hills, Dubai Creek Harbour, Jumeirah Village Circle, and Business Bay.

Top Tilal Al Ghaf Villas: ROI & Rental Yield 2026

4 Bedroom Villa

| Project | Sale Price* (Last Transaction) | Sq.Ft | Service Charge (AED / Sq.Ft) | Avg. Price Per Sqft* (1 Year Change) | Estimated Gross ROI* | |

| 1 | Harmony 2 Tilal Al Ghaf | 8,100,000 | 4,650 | 2.93 | +8.97% | 5.9% |

| 2 | Harmony 1 Tilal Al Ghaf | 8,700,000 | 4,504 | 2.93 | +17.20% | 5.5% |

| 3 | Elan 1 Tilal Al Ghaf | 4,500,000 | 2,173 | 2.51 | +17.76% | 5.5% |

| 4 | Alaya Gardens | 12,825,000 | 6,323 | 0.62 | +8.08% | 5.5% |

| 5 | Harmony 3 Tilal Al Ghaf | 9,100,000 | 4,650 | 2.93 | +28.30% | 5.4% |

| 6 | Aura 2 Tilal Al Ghaf | 6,400,000 | 2,366 | 5.01 | +15.53% | 5.2% |

| 7 | Aura Gardens Tilal Al Ghaf | 6,675,000 | 2,373 | NA | +15.98% | 5.1% |

| 8 | Amara (off plan) | 8,550,000 | 3,936 | 0.65 | +3.21% | NA |

Quick ROI Tools

👉 Use our FREE Long-Term Rental ROI Calculator or our Airbnb ROI Calculator to project your earnings.

Investor Insights: What to Check Before Buying in Tilal Al Ghaf location

1. Premium Prices & Below Average Rental Yields

Tilal Al Ghaf isn’t a cheap community to buy into. Entry prices are higher than most comparable townhouse and villa areas in Dubai, and price growth so far has been driven more by end-users than yield-focused investors.

For buyers entering at today’s prices, net rental yields typically sit below 5%, although this can vary depending on when and what you buy.

2. Lagoon and beach club delivery is still ahead

The lagoon is a big part of the community’s long-term appeal, but not everything is fully delivered yet. Key amenities, including the beach club, are expected around 2026–2027.

In other words, part of the lifestyle premium is already priced in, while some of the value is still future-facing.

3. Not a Pet-Friendly Community

If you’re a pet owner, this is something to be aware of. Tilal Al Ghaf has fairly strict pet rules, and aside from guide dogs and small pets like fish, most pets aren’t allowed. Any permitted dogs also need to be kept on a leash at all times.

4. Limited Public Transport

This is very much a car-dependent area. Public transport options are limited, with the closest metro stations – Jumeirah Golf Estates and DMCC – both a 15–20 minute drive away.

5. Construction and Traffic Realities

As the wider master community continues to take shape, some construction noise and disruption is unavoidable in certain pockets. Hessa Street, which runs alongside Tilal Al Ghaf, is also known for traffic.

Bottom Line: Tilal Al Ghaf is better suited to medium- to long-term investors. Investors looking for quick resales or short-term speculative flips may find fewer opportunities.

Final Takeaway – Are Tilal Al Ghaf Villas Worth the Price?

Tilal Al Ghaf does deliver on its promise of a quieter, more lifestyle-focused environment – especially compared to denser villa and townhouse communities. That said, the premium pricing reflects long-term appeal rather than short-term returns.

For buyers who value space, planning, and long-term livability, it can justify the price. For yield-driven investors, the value equation needs a closer look.

FAQs About Buying Properties in Tilal Al Ghaf

Q: What are the main sub-communities in Tilal Al Ghaf?

Popular clusters include Elan, Aura, Harmony, and Alaya Beach, each offering unique property options.

Q: What is the Rental Yield in Tilal Al Ghaf?

Units in Harmony 2 Tilal Al Ghaf and Elan 1 Tilal Al Ghaf – currently deliver 5.5–5.9% Gross Rental Yield.

Q: Are Tilal Al Ghaf villas good investments in 2026?

Tilal Al Ghaf is better suited to medium- to long-term investors. Because entry prices for villas in Tilal Al Ghaf are higher than in many other townhouse and villa communities in Dubai, it’s not the best fit if your goal is strong immediate cash flow, entry-level deals, or quick resale.

Q: What’s the difference between Tilal Al Ghaf, Arabian Ranches and Dubai Hills for investors?

Tilal Al Ghaf offers a newer, lagoon-centric lifestyle with modern layouts and stronger long-term upside

Arabian Ranches is more mature, price-stable, and favoured by end-users seeking established communities over growth potential.

Dubai Hills offers a more balanced risk-return profile, combining scale, stronger liquidity and golf-centric living.